I just started doing my taxes, phase 1 that is. I usually hash it out in 3 or 4 phases, the first being the most time consuming where I sit down with the folder of receipts and forms I’ve diligently collected over the year and for a few hours go through most everything I can.

One of the biggest uncertainties for myself, and I know for many, was dealing with the implications from the Affordable Care Act, aka “Obamacare.” You’ll be forced to pay a penalty if you don’t have insurance. But I’ve confirmed how to avoid paying this penalty. I’ll show you how.

I get about 90% of my taxes completed when I sit down the first time. I then come back a couple of times over the next few weeks when I receive paperwork I was waiting on and do a final walkthrough.

The U.S. is now fully engaged in Obamacare and 2014 was the first full year of practice. That means when you’re doing your taxes you’ll be asked about your health insurance. Most importantly you’ll be on the hook for the penalty if you went without it for portions of 2014.

How Much is the Penalty?

For 2014 (and the taxes you’ll file in a couple of months) the penalty is either $95 or 1% of your taxable income, whichever is more.

Don’t overlook that last part. I’ve talked with friends who don’t have insurance who think it’s no big deal just to pay $95. But if your taxable income is $30,000 a year, you’ll owe $300. Or maybe it’s $50,000? That’s a $500 penalty.

“Penalty” vs. Tax

Back in 2012 the Supreme Court ruled that Obamacare was a “tax.” As they believed taxes were legal for the government to impose, that Obamacare was legal. The penalty is simply added or not added to your return when you do your taxes.

It’s a much easier way for the government to enforce this than sending out bills or shipping cops off to go door to door. If your refund on April 15th is $1,000 but you owe a $500 penalty, that refund goes down to $500.

Or if you don’t owe anything but get hit with the $500 penalty, now you owe $500 on your taxes.

It Will Continue to Go Up

“Open Enrollment” through HealthCare.gov ends in just a few days on February 15th.

Keep in mind that the “$95 or 1% of income” rule was only for 2014. In 2015 it shifts to $325 or 2% of income. And in 2016 it’s $695 or 2.5%.

I’m a personal believer that it’s much wiser to invest your time, money, and resources into staying healthy as opposed to spending an absurd amount on health services and insurance.

So as a young, healthy person who eats well and exercises, I’ve gone without health insurance many times in my life.

And before Obamacare I wouldn’t feel strange encouraging others to do the same, save maybe grabbing some type of catastrophic coverage in case of tens of thousands of dollars needed for an accident or major surgery.

The base amount isn’t a big deal, but the percentage is what gets you. The idea that I’m penalized more by working hard and making more money, is a hard pill to swallow.

If I’m making that $50,000 example, next year a full 2% of my income will be stolen from me. Waving goodbye to $1,000 is not something I want to do, so like it or not, my only real option is to get insurance. Or is it?

Health Share Ministries are a Legal Exemption

It didn’t get a ton of coverage during the Obamacare back and forth, (and it still doesn’t), but there were multiple exemptions placed into the law. There are actually a number of ways to avoid the penalty. Forbes magazine has a post here on there being about 15 of them.

Unfortunately most of them will most likely not apply to you. From being homeless or being evicted to spending some time in jail, the average person doesn’t have these options and will therefore be stuck.

However one exemption that stands out that can benefit you just as it’s benefited me. You can avoid the Obamacare penalty if you are a member of a recognized health sharing ministry. It can potentially save you hundreds or even thousands of dollars.

What Exactly is a Health Care Sharing Ministry?

According to the Obamacare law, an additional way to be exempt from the tax/penalty is if you are involved with a health care sharing ministry recognized by the government.

Obamacare does go into some detail about what qualifies a group as being acceptable. The largest point seems to be that it needs to have been in existence since at least 1999.

A health care sharing ministry is not technically insurance. Instead of paying insurance premiums, you pay a sharing premium to the organization. Your money is then pooled and doled out to other members who submit claims.

So paying, let’s say $200 a month, gives me the ability to then submit a claim for medicine or a procedure.

Instead of an insurance company paying for my medical bills, it’s my friends, family, and other members across the country who pay my medical bills via the money in the pot. That’s a very approximate overview, there’s more to it.

There are three sharing ministries that I am familiar with and from initial research, indicate they fulfill the requirements.

All three of these companies have existed prior to the end of 1999 and therefore quality for exemption.

Two things that do stick out though. This doesn’t seem entirely fair to:

A) New companies who want to start in this field. If the government will allow these exemptions, why not allow others? or especially

B) Individuals who do not consider themselves to be Christian, or religious at all. The three groups above are all Christian health care sharing organizations with a heavy emphasis on Biblical principles.

As a Christian I support those principles and it’s great that I have a chance to avoid paying extra taxes by being involved with them. Though as someone who doesn’t believe in stealing from one group to benefit another, it seems unfair to only permit Christian groups to exist. It doesn’t seem very fair or “American” to me, to only give this right to one specific religion or not give it to people who have a different religion or no religion at all.

A Possible 4th Option

There is possibly a fourth option, “Liberty Health Share” which also bills itself as a health sharing organization that qualifies for the exemption. The difference with Liberty is that it’s not specifically a religious group.

I’ve heard from both sides on this, some research indicating Liberty is a completely acceptable option, and some saying the opposite.

There is some discrepancy as to whether Liberty in its current form existed in 1999, or if it was re-compiled and re-branded, and whether it officially is recognized as an option by the government.

I’m not a lawyer or accountant so I can’t say either way. Perhaps if someone from Liberty is reading this they can chat with me and list out the details of it.

I’ve also heard only in passing and in passing internet searches that there are other groups. I don’t know enough to confirm or deny whether these fulfill the requirement, so I cant speak to those. In any case, I decided to go with one of the groups I knew would be acceptable.

I went with Christian Healthcare Ministries

The three Christian health care sharing ministries all operate roughly the same with slight differences among the three. They do have some differences when it comes to your lifestyle for example, and pledging to live (or not live) a certain way.

And though they are all Christian organizations, not every one required that I submit proof of my faith or any type of thorough application. I am a Christian, but I could have been anything else and it seems like I would have received the paperwork all the same.

If you’re looking at either of these three I’d encourage you to examine what you feel comfortable signing up for and promising to do (or not do).

For me, the almost exclusive determining factor was price. Right or wrong, smart or stupid, I revert back to being a young, healthy person with no dependents. It doesn’t make financial sense to pay $200, $300, even $500 a month for expensive health insurance coverage, “just in case.”

I’d prefer to save and invest the money I would have otherwise put towards health insurance. I then either go without insurance, or pick up coverage that has a very high deductible and low premiums that protects me in a catastrophic situation.

At the moment I simply want something that will provide me basic coverage in case of an accident and allow me to avoid the Obamacare tax.

Christian Healthcare Ministries had the least expensive option. Their Bronze program is $45 a month with a $5,000 deductible. $5,000 is a a lot, but not so much that I’ll be destitute should I suffer a life changing accident or need a substantial surgery.

If I decide to, I can bump it up to $85 a month for the Silver program, which lowers my deductible to just $1,000.

Your Penalty is Pro-Rated

As I went through my taxes, I was able to see the full implications of the program. I was covered through my job through June, begun some travel, and then had a chance to finally sit down and go over health care sharing options in the fall. I signed up then.

I knew that for at least part of the year, I was without insurance and would likely have to pay the penalty.

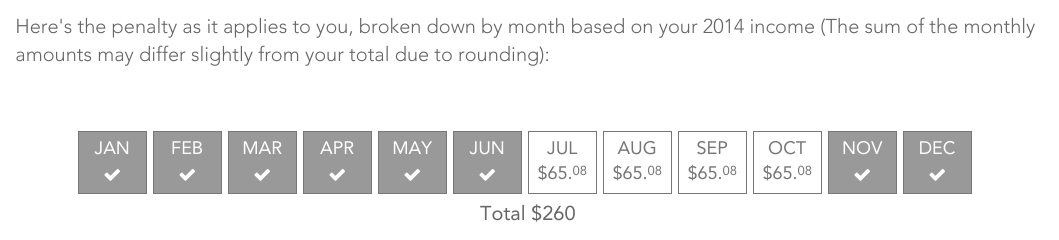

I enrolled in the sharing ministry in November through the end of the year. From a screen shot of my turbo tax filing below, you can see I only have to pay the penalty for four months, at about $65 a month $260.

Now that I’m fully enrolled in a sharing ministry, I’m exempt from the tax from now on.

A Solid Option

I haven’t used the coverage so I can’t comment on Christian Healthcare Ministries just yet. Though I have received my welcome packet and it was quite in depth. It was filled with a lot of information and it specifically did focus on the Christian aspect of the company.

I received a newsletter and note cards with the names of fellow members who had medical needs, asking me to pray for them.

Perhaps I’ll cover Christian Healthcare Ministries with a full review in a later post, as well as delve more into the other sharing ministries. For now, if you’re getting ready to do your taxes and went without insurance at any point in 2014, you’re seeing the tax implications in front of you.

If you are still without insurance take the steps now to avoid having a huge tax bill in 2015 and having even more of your money fly out the window.

Perhaps you currently have insurance but either think its way expensive or you don’t want to switch, less you’ll have to pay the penalty. Consider a health care sharing ministry to lower your costs, though be aware of the differences between a sharing ministry and traditional coverage.

Either way, there is absolutely no reason you should pay the Obamacare penalty in tax year 2015. Take the steps now to put more money in your pocket next year.

Have your used a health care sharing ministry before or are considering one? Comment below with your thoughts, suggestions or concerns.

2% of $50,000 is $1,000 😉

It is! Good catch!

Steve, do you think #14 from the Forbes article would work when filing taxes?

It’s a great question William, what exactly does “another hardship” count as? I certainly wouldn’t want to wait on the government for an explanation.

I also use Christian Healthcare Ministries. I haven’t had to use coverage yet, but like their newsletter and prayer requests. They also send information about how to donate to someone in need. Seems like a great organization.