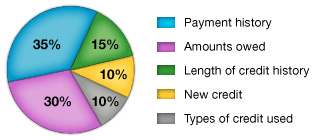

My recent post, “5 Points: What the Heck is a Credit Score?” touched on five pieces of info I thought would be helpful to provide a basic knowledge of a credit score. Here I’ll outline a summary of the five pieces of the pie that comprise your credit score, how much each is worth and how to improve it.  Do a search for “credit score chart” and you’ll find some variation of the graphic above. Remember your credit score is simply an indication to a creditor of how likely you are, (or are not) to pay your bills. While the credit bureaus do not release exact details of each and every factor of your score, we do know that these five factors are what determines it. The five pieces of the pie in order of importance, are:

Do a search for “credit score chart” and you’ll find some variation of the graphic above. Remember your credit score is simply an indication to a creditor of how likely you are, (or are not) to pay your bills. While the credit bureaus do not release exact details of each and every factor of your score, we do know that these five factors are what determines it. The five pieces of the pie in order of importance, are:

- Payment History – 35% This is the biggest piece of the pie and is simple to determine. Do you pay your bills on time? That’s really it. Paying the minimum each month vs. paying off in full may lead to interest and finance charges, but it won’t hurt your credit. But missing a payment or being late with a payment, that hurts. A lot.The absolutely, positively, unequivocally worst, terrible, no good, very bad, thing you can do to your credit score is to miss payments and/or pay bills late. Just don’t do it. If there’s a silver lining, late payments do fall off your credit report after a number of years. But the key word here is: YEARS.

- Amounts Owed – 30% Also pretty simple to determine. The amount you owe or your “Credit Utilization.” The good thing about this piece of the pie is that contrary to dealing with a late payment, you can see improvements very quickly. “Utilization” is simple. What percentage of my credit am I using or utilizing?If I have a credit card with a $10,000 limit and my balance is currently $1,000 – then I’m using 10%. If my balance was $2,000 then it’s 20%. $5,000 and it’s 50%. The lower percentage I’m using the better. Being maxed out at 80% or 90% for example, tells a creditor that I’m stretching myself out. These two lovely ladies are the belles of the ball. Together they make up 65% of your score. The next three are important, however it is impossible to have a good overall score without being on good terms with the first two.

- Length of Credit History – 15% How long have you been using credit? If you’ve had a credit card (and always paid on time) for the last 10 years, then your score in this category will be higher than if you’ve had a card for only 5 years. Banks want to see stability, so there is a reason 20 year olds will always have lower scores than 30 year olds when all other factors are equal. The good news is you can’t really screw this piece up. The bad is the only way to improve it is over time.Unless there are substantial factors at play, you should always keep your oldest credit card open. Even if you don’t use it or the rewards points are terrible, NEVER close it. The old card will help the average age of your reports. Lock it in a drawer and make a charge once every few months but never close it. A mistake I made at 22 was closing a credit card I had gotten when I was 20. “Finally!” I thought. “I paid off my credit card balance and am credit card debt free. OBVIOUSLY I should close it out!” That was a mistake. I could have had an extra three or four years of credit history to help my score.

- New Credit – 10% How often you apply for credit cards, loans, mortgages, etc? The more times you apply for a loan, the more banks will see you’re in need of cash. The running joke is that no creditor wants to lend money to a man who really needs it, because maybe he won’t be able to pay it back.

- Types of Credit Used – 10% Having different types of loans will actually help your score. A couple of examples are: Revolving Credit and Installment Credit. Revolving means it’s a constantly revolving balance. Credit cards are revolving credit. One month you may owe $200 and the next you might owe $2,000. Like a revolving door, it spins around with different types of people, (or purchases) coming in and out.Installment is a mortgage or car loan or student loan. It’s the same amount each month owed. A set installment of the principle each month.

Leave a Comment

Comments are closed.