After my post on how I got two free tickets to Alaska, I had some friends ask how credit card applications affected one’s credit score. And in those discussions, they relayed that if they were completely honest, they had no idea how a credit score worked. So based on those talks and thinking it might be helpful to some, I put together a very basic primer on your credit score and what’s important to know about it.

“The Credit Score…” dun dun dunnnn… This is a grand mystery for many. We know it affects our car loans and mortgage rates but we don’t fully understand it. And even today the credit bureaus don’t provide exact details on the formulas they use. A few google searches will give you some good knowledge of the topic, though you could probably spend all day learning the ins and outs. Here are five things to get you started.

1. The main credit score used is the FICO score, which was developed by a group about 25 years ago by “Fair, Isaac, and Company” (FICO.) There are other scores but FICO is by far used more often for the average person. That’s the one used for most everything so we’ll be talking about that.

2. A “Credit Score” is a misnomer. There are actually three different credit bureaus, Experian, Equifax, and TransUnion who all have a different score. Try to get your “FICO” score and you’ll see ads for one bureau or another, or promotions for, “Get all 3 Credit Scores!” If you want the most in-depth info on your, “credit score,” you should get all three. I personally use CreditScore.com to get mine once a year. Keep in mind you’ll have to pay for this and it’s one of those, “We’re signing you up for a recurring charge of $10 a month.” But I always just pay the $10, get the scores, and then call the next day to cancel the recurring charge. I’ve never had a problem. Some credit cards are starting include reports with your score for free, but it’s not typically all three scores. I highly recommend knowing exactly what your score is and doing a once a year check on it.

3. Within the FICO score, the “classic” score is the one most told to consumers. This ranges from between 300-850. The higher the score, the better.

4. From my experience, everything I’ve read, and talking with many responsible associates, it’s more difficult to raise your score the higher it gets. The credit bureaus keep exact details to themselves. I know very well-to-do people with, good jobs, good savings, and no history of bad debt or late payments who have never broken 800.

5. Anything around 675/680 to 700 is generally viewed as good while anything in the mid 700’s is excellent. While a better score will help you get approved for a loan or get a lower interest rate, there seems to be a limit. Once you get to a certain point (some say 720, some say 750 and some in-between) you’ve already qualified for the best rates. So other than prestige, a score of 750 vs a score of 760 will probably yield you the same results.

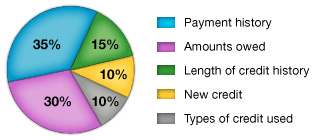

So what exactly makes up your credit score and how is it affected? There are five major pieces to the pie. In the next post I’ll go over a brief summary of the five categories that affect your credit score and how to improve each one.

Steve– Direct people to annualcreditreport.com to get a free copy of their credit report once per year.

Patrick absolutely! Had a post already scheduled touching on it!

i posted a similar thing – with lots of info about my own score.

http://www.igobyplane.com/2014/02/27/what-about-my-credit-score/

trying to get some friends to jump into the card game and not to worry so much about this stuff. my more recent activity can be seen in the creditkarma image – and i actually just got my experian score the other day, over 780.

Mike thanks for the add. I’m on the same track here with some friends as well. Encouraging them to realize that travel doesn’t have to be expensive and credit cards can get you there without hurting your score.