One of the best way to pick up points and miles that you can later redeem for travel, is through credit card signup bonuses. When you see a card advertising, “Get 40,000 free bonus miles!” that’s the signup bonus. When you get the card and hit the minimum spend, you’ll receive those points/miles. I’ve gotten a $6,000 first class plane ticket for just $30, I’m saving thousands of dollars and staying at the most luxurious hotels in Maui, and I just claimed two basically free flights to Alaska and back.

When I explain how I’m able to travel, sometimes quite luxuriously, using credit signup bonuses, the question/statement I most often hear is, “Will applying for credit cards hurt my credit score?” or “That will definitely hurt your credit score!” I’ve explained here some of the ways that it won’t.

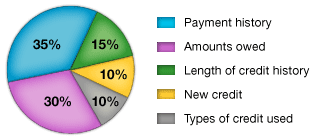

Understand what makes up your credit score

As long as you understand your credit, are responsible with your finances, and can handle debt, you can make credit cards work for you. I’ve gone through the five aspects of your credit score here, and how each plays an intricate part in your finances (and travel strategy).

Eight credit cards, six months, and five points

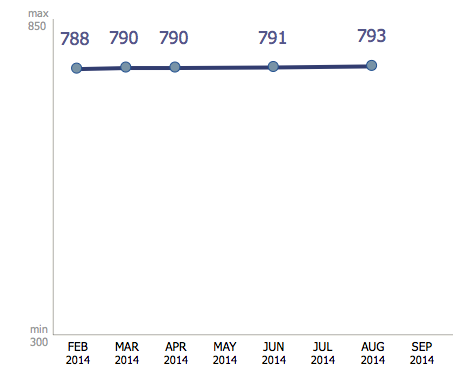

Some credit cards, such as the Barclay World Arrival offer a free FICO credit score listing each month. Barclays gives you a number of free financial tools (for having the card), and one of which is your TransUnion credit score.

In the interest of writing posts helpful to my readers, I feel comfortable discussing my personal credit score. I’ve never missed a credit card payment, am responsible with my spending, and have a history of using credit responsibly. Therefore my three credit scores are great, ranging anywhere from 770-790 over the last year or so. In the case of my TransUnion score, it’s currently at 793.

In a roughly six month span from February until early September, I applied for a total of eight credit cards, a mix of personal and business cards, (check out Daraius’ discussion here how you may be able to pickup a business credit card). Convention wisdom tells us that MUST be harming my credit score, but it’s not the case.

In six months my TransUnion score has actually gone UP five points, now standing at 793. The running joke when it comes to your credit score is that there’s no prize for being at 790 instead of 780 or 770 or 760, etc. 720 is typically seen as an excellent score (some say 750), and will qualify you for the best rates and loans. Anything over that may help your ego, but it won’t improve much else.

That’s why if you’ve got a credit score at 760 or 770 and are worried about applying for a credit card (each new application will take between 2-5 points off your score), there’s really no reason to worry. Again, other than the good feeling you’ll get from having a super high score, you can afford to trade in some of those credit points to reap the benefits of a new credit card bonus.

Overall

While I still have friends insist, “You’re definitely hurting your credit score by applying for cards,” the evidence speaks for itself.

1. It’s actually okay to “hurt” your credit score if you’re score is already super high. Whether my score stays in the 790’s or drops to the 770’s, it won’t have any affect on my finances. I’d rather “hurt” my score and pick up some new credit card bonuses.

2. Even my applying for eight new credit cards over a six month period, my credit score actually increased five points. Despite multiple applications my score is hovering just shy of 800. Not too bad.

How about yourself? Do you know what your credit scores are? Are you tracking how it’s progressed and are you willing to trade some credit points in order to earn other rewards?

People generally have no clue how credit scores work and are so leery of credit cards for fear of “hurting” their credit score.

Personally mine has hovered around 805 but recently dropped to 802. OMG! Though, like you said, it means nothing really , I will probably freak out if it goes below 800.

And for the record I apply for probably 10-12 cards a year. And I’m still in the 800s.

That’s the way to do it Laura!