There are definitely a few things that I look back on and say, “My parent’s were right.” When it comes to finances, one of those things was their suggestion to open and heavily contribute to an IRA, aka an “Individual Retirement Account.” I did so very early on, right after graduating college, and have been contributing ever since.

However I can’t say I’ve always contributed and invested the max each year, and that’s something I definitely look back on and wish I had. That’s why the point of this post is to convince you to stop what you’re doing and right this very second open a Roth IRA.

Roth IRA vs IRA

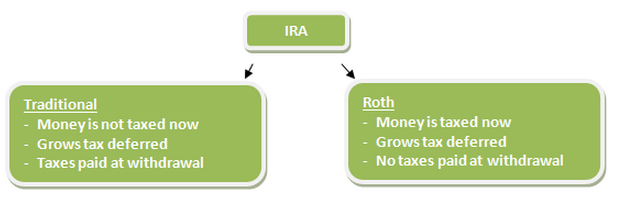

There are differing opinions on an IRA vs a Roth IRA. A Roth IRA is the same basic retirement account but with a twist. With an IRA you contribute money and get a tax deduction for it. In 20 or 30 or 40 years when you sell your investments however you have to pay taxes on it.

With a Roth IRA, you contribute money like you do into a savings account, no tax deduction. However when you sell your investments down the road, you get all of it 100% tax-free. If you buy Facebook or twitter stock at $20 and in 40 years it’s at $2,000, then all of that money is yours. No taxes at all. You can see a comparison of the two here.

There are a few extra steps you have to take to ensure you do it properly but for the most part it’s pretty simple. For me personally and for most people age 18-30, I’d recommend the Roth IRA. As most people in that age bracket are still early in their careers and will be making more money later on in life, it makes sense.

Plus, take an honest look at the government (really any government) and how mismanaged and stretched thin they are. Tax rates continue to go up because politicians continue to spend. Do you honestly think tax rates will substantially go down? My bet is they’ll go up, so if you can protect yourself against that, you should. That’s why a Roth IRA makes sense to me. When I take my money out it will be tax-free, and I like that, (until the government figures out another way to steal it, I suppose!)

The Deadline

You have until April 15, (tax day) to make contributions to your IRA, that count for the previous tax year. That’s important to note. The rules with IRA’s and Roth IRA’s is that you can only contribute so much per year, but the account MUST be opened prior to the tax day deadline (April 15th) order to make contributions retroactively for the previous tax year.

—

For the most part you can NEVER go back and contribute to a previous year. 2010, 2015, 2020… those years have passed, and you are not able to write a big check to catch up.

(Technically at age 50 there IS a way to contribute more via something actually called a “catch up contribution”, but this is just a basic overview so I won’t confuse you with more details.) The point is, if you don’t want to miss out on the investment year, you need to open your IRA or Roth IRA as soon as possible.

However don’t despair if you don’t have a Roth IRA because it’s absolutely never too late to start.

Don’t Miss the Opportunity

I understand thinking about investments and numbers is not at the top of your list. But if nothing else, I’m offering you advice from personal experience. I’d guess I’m probably in a small percentage, maybe 10% or so of people in their 30’s or younger who have a Roth IRA and consistently contribute… and even I think I’m behind everyone and running to play catch up.

I can’t say that I’ve maxed out my contributions every year since I opened it, but looking back, I definitely wish I would have found a way to do so. Do everything you can to get the full benefit of every tax year. That’s an entire year of investment opportunity and 20, 30 or 40 YEARS of compounding interest that’s lost forever.

I personally use a couple of different companies for Roth IRA’s and am a big fan of index funds, specifically through Vanguard. However most of Vanguard’s index funds require at least $3,000. If you weren’t planning on opening a Roth IRA, then realizing you all of a sudden need $3,000 and you probably are thinking, “Sounds great Steve but I’ll pass.”

However, the company I used to open my first Roth IRA, and still use for some of my investments, is TD Ameritrade. I’ve found that for times when I wanted to contribute cash but did not want to make an immediate investment, it worked well. In the case I made the contribution, I had it sit in the “Money Market” portion of the account, just like a bank account, and then dealt with it later on.

Seriously, don’t blow this off, and don’t “Get to it later.” Stop what you’re doing or take a few minutes on your lunch break and do this.

By opening a Roth IRA you’ll already be ahead of probably 90% of your peers and while I can’t guarantee you’ll thank me later… I’m pretty confident you’ll thank me later.

Ok, just so I have this correct… BOTH a Roth IRA and traditional IRA will lower your taxable income for the current tax year based on your contribution amount. But when you say you pay tax now for the Roth, what do you mean? Earnings grow tax free for both accounts, so how and when do you pay tax on Roth acounts? So confusing…

Ken not quite. A Roth IRA will not lower your taxable income for the current year. Earnings do NOT grow tax free for both accounts. Think of it this way:

IRA: You get a tax deduction when you contribute. Just like you get a tax deduction when you donate to charity. However when you take our money/investments in 20 or 30 or 40 years, you are taxed on that income.

Roth IRA: The opposite. No tax deduction for contributing. However all of the income/investments you make when you withdraw in 20 or 30 or 40 years is all yours to keep.

Ok gotcha, thanks. I’m planning on my income being fairly low come retirement time so I’d be better off paying taxes when I take distributions than I would now. I plan to live off dividends in retirement.

That’s certainly a good plan if you can make it work Ken. Living off dividends is a great way to achieve a level of financial freedom!